Association Employee Benefits Retirement Solution

What is it?

Association Employee Benefits Retirement Solution

The Association Employee Benefits Retirement Solution revolutionizes retirement planning in the industry, providing a comprehensive array of pooled solutions that gives clients various options. Whatever size business you have, the Association Employee Benefits Retirement Solution offers plans tailored to uniquely meet your needs while providing competitive pricing that generally goes hand-in-hand with large-scale setups.

The flexibility to meet your needs

Comparing your options

The Association Employee Benefits Retirement Solution product is unique because it consists of two plan configurations: Retirement Plan Exchange® and Choice Pooled Employer Plan℠.

Retirement Plan Exchange®

Retirement Plan Exchange® allows individual sponsors to select from a menu of cost-effective options to build a single-employer retirement plan and configure a support team.

- Individual plan sponsors choose from a menu of cost-effective options to build a retirement plan

- TAG Resources handles plan administration and prepares, signs, and files the Form 5500 on behalf of the company

- Typically, best suited for smaller businesses and organizations not subject to a plan audit

Choice Pooled Employer Plan℠

Choice Pooled Employer Plan℠ treats the plans of multiple unrelated employers as one large plan that benefits from reduced audit costs.

- Treats multiple plans as one large plan

- Sponsored by and includes independent fiduciary oversight by a pooled plan provider (PPP)

- The PPP manages administration and oversight

- One combined Form 5500 and single audit for the PEP

- Audited plans benefit from reduced audit costs

Administrative responsibilities

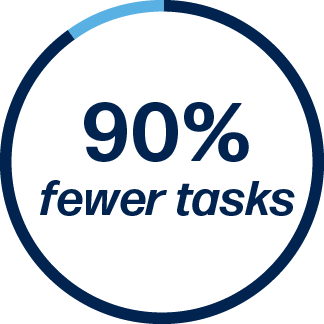

The Association Employee Benefits Retirement Solution removes more than 90% of your administrative tasks compared to a single-employer plan.

Your load is lighter with the Association Employee Benefits Retirement Solution.

As a retirement sponsor, your primary responsibilities* are to select and monitor service providers and:

- Upload payroll files**

- Collect year-end data**

Without the Association Employee Benefits Retirement Solution, your responsibilities are:

- 3(38) Investment Manager Appointment, Monitoring, and Removal (if applicable)

- 402(g) Limit Reporting

- 404(a)(5) Notice Distribution

- 404(c) Notice Distribution

- 408(b)(2) Notice Distribution

- Annual Discrimination & Coverage Testing

- Auto-Enrollment Notice Distribution

- Beneficiary Determinations

- Blackout Notice Distribution

- Census Review

- Corrective Distributions

- Death Benefit Approval

- Distribution Processing

- DOL and IRS Issue Resolution Assistance

- Eligibility Calculations

- Eligibility Notifications

- Plan Contribution Monitoring

- Error Correction Monitoring

- Force Out Processing

- Form 5330 Preparation & Filing

- Form 5500 Preparation, Signing, & Filing

- Form 8955 Preparation, Signing, & Filing

- Fund Change Notice Distribution

- Hardship Withdrawal Approval

- Loan Approval & Reporting

- Loan Default Monitoring

- Loan Policy Administration

- Lost Earnings Calculations

- Participant Enrollment Assistance

- Payroll Aggregation

- Plan Design Review

- Plan Document Interpretation

- Plan Document Preparation & Archiving

- QDIA Notice Distribution

- QDRO Determinations & Reporting

- Required Minimum Distributions

- Safe Harbor Notice Distributions

- Summary Annual Report Production & Distribution

- Summary of Material Modification Notice Distribution

- Summary Plan Description Production & Distribution

- Termination Date Verification & Maintenance

- Termination Withdrawal Approval

- Vesting Verification & Tracking

- Year-End Data Collection & Review

Let us make your job easier

Improve accuracy, save time and effort

Simplified payroll and recordkeeping

PayStart provides a service for qualifying clients that allows contribution data to be sent directly from the payroll vendor to Transamerica, eliminating the need for the plan sponsor to create and manipulate a separate file. This can help your organization:

Save time

Transfer of participant compensation, contribution, and other data to Transamerica happens automatically and securely

Reduce costs

Payroll uploads and deferral changes are no longer time-consuming tasks, allowing for more efficiency

Improve accuracy

Automated integration reduces opportunities for compliance issues and can save your staff time from dealing with errors

Enhance productivity

With automation, staff can recover their time and focus on other important matters

The Bedrock Reporting System™

TAG Resources proprietary software

With data gathered from contribution files from the plan sponsor and recordkeeper, TAG can match employees with specifics provided in the plan document to determine eligibility and verify participant information. In addition, the system captures rate changes, new loans, and hardship withdrawals and monitors contributions and distributions to ensure compliance with plan documents and 401(k) limits. Every step in the process is time-stamped, so the complete data cycle is monitored. The system allows TAG to monitor operational health and catch minor errors before exposing the plan to compliance violations.

Advantages & core benefits

The advantages with the Association Employee Benefits Retirement Solution

Making it simple

Employers don’t want to be 401(k) experts. TAG Resources supports plan setup, implementation, monitoring, enrollment, and other duties.

Fiduciary protection

Employers don’t want to be at risk. By shifting administrative and certain named fiduciary duties to TAG and the PPP, if participating in the Choice PEP, employers can significantly reduce their defined legal obligations and responsibilities.

Compliant

Employers don’t want fines or penalties. The plan uses processes developed to administer plans according to Department of Labor (DOL) and IRS guidance to help avoid compliance issues.

Well-known providers

Employers want to work with industry leaders. The Association Employee Benefits Retirement Solution combines industry-leading professional service providers for "end-to-end" retirement plan oversight, including robust tools and resources for employees.

Cost-effective

Employers don’t want to overpay. The Association Employee Benefits Retirement Solution is built on a pooled pricing model and may cost less than other programs offering fewer comprehensive services.

Meet the team

Financial Advisor

Lisa Samuels

Lisa is great to work with, and she plans to bring many plans with this association.

Plan Administrator Type 3(16) & 402(a)

TAG Resources

TAG Resources is a named fiduciary as a plan administrator and a non-investment 3(21) fiduciary under ERISA sections 402(a), 3(16), and 3(21). It is our job to perform all functions necessary to keep your plan compliant.

As such, TAG Resources is responsible for the day-to-day operations of your plan. The functions we perform on your behalf include services such as: the signing and filing of the Form 5500, QDRO determinations, plan operations, participant claims and appeals, distributions, and beneficiary determinations.

Recordkeeper

Transamerica

Transamerica is an industry-leading recordkeeper with nearly 25 years of experience with pooled arrangements. Our time-tested recordkeeping technology offers a proven infrastructure allowing for pooled arrangements, ensuring a plan will be administered successfully and accurately for the plan participant’s transition to retirement.

Association Employee Benefits Retirement Solutions

NMPA

Contact your Association 401(k) Business Partners at T. Spencer Samuels to request more information about opening a 401(k) Retirement Solutions Plan through your member company.

Association Employee Benefits Retirement Solutions

USSA

Contact your Association 401(k) Business Partners at T. Spencer Samuels to request more information about opening a 401(k) Retirement Solutions Plan through your member company.

Association Employee Benefits Retirement Solutions

MIAPBC

Contact your Association 401(k) Business Partners at T. Spencer Samuels to request more information about opening a 401(k) Retirement Solutions Plan through your member company.

Participant experience

Driving participant success

The Transamerica participant experience is designed to help people understand if their savings and investment strategy is in line with their retirement goals. It starts with enrollment and continues with personalized communications and financial education showing participants how they can improve their retirement readiness.

An easy-to-understand forecast is generated by the underlying methodology provided by Morningstar. Using simple weather icons, it shows participants if their current investment strategy is likely to produce the income they’re seeking in retirement and offers steps to improve their chances of achieving their goals. Your Retirement Outlook® is featured prominently on the participant website, mobile app, and quarterly statements.

Transamerica

24

408

13,513

Call or email us today

Call 561-658-1078 or email us at lsamuels@iaac.com. We are ready to help.