San Joaquin Society for Human Resource Management - Transamerica Choice Pooled Solutions℠

What is it?

Transamerica Choice Pooled Solutions℠

Transamerica Choice Pooled Solutions℠ revolutionizes retirement planning in the industry, providing a comprehensive array of pooled solutions that gives clients various options. Whatever size business you have, Transamerica Choice Pooled Solutions℠ offers plans tailored to uniquely meet your needs while providing competitive pricing that generally goes hand-in-hand with large-scale setups.

The flexibility to meet your needs

Comparing your options

Transamerica Choice Pooled Solutions℠ is unique because it consists of two plan configurations San Joaquin Society for Human Resource Management can use to tailor a plan for your clients: Retirement Plan Exchange® and Choice Pooled Solutions℠ (PEP).

Retirement Plan Exchange®

The Retirement Plan Exchange® allows individual sponsors to select from a menu of cost-effective options to build a single employer retirement plan and configure a support team.

- Individual plan sponsors choose from a menu of cost-effective options to build a retirement plan

- TAG handles plan administration and prepares, signs, and files the Form 5500 on behalf of the company

- Typically, best suited for smaller businesses and organizations

Choice Pooled Solutions℠

The Choice PEP treats the plans of multiple unrelated employers as one large plan and allows employers to choose from two cost-effective investment platform options.

- Treats multiple plans as one large plan

- Sponsored by a pooled plan provider (PPP)

- PPP handles administration and oversight

- Files one combined Form 5500 for the PEP

- Large plans benefit from reduced audit costs

- Your choice of 3(38) investment managers

Administrative responsibilities

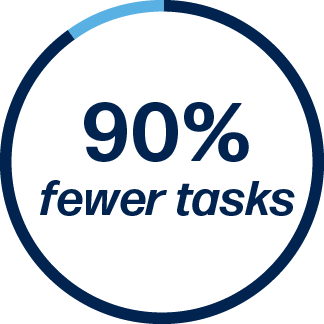

Transamerica Choice Pooled Solutions℠ removes more than 90% of your administrative tasks compared to a single-employer plan.

Your load is lighter with Transamerica Choice Pooled Solutions℠

As a retirement plan sponsor, your primary responsibilities* are to select and monitor service providers and:

- Upload payroll files**

- Collect year-end data**

Without Transamerica Choice Pooled Solutions℠, your responsibilities are:

- 3(38) Investment Manager Appointment, Monitoring, and Removal (if applicable)

- 402(g) Limit Reporting

- 404(a)(5) Notice Distribution

- 404(c) Notice Distribution

- 408(b)(2) Notice Distribution

- Annual Discrimination & Coverage Testing

- Auto-Enrollment Notice Distribution

- Beneficiary Determinations

- Blackout Notice Distribution

- Census Review

- Corrective Distributions

- Death Benefit Approval

- Distribution Processing

- DOL and IRS Issue Resolution Assistance

- Eligibility Calculations

- Eligibility Notifications

- Plan Contribution Monitoring

- Error Correction Monitoring

- Force Out Processing

- Form 5330 Preparation & Filing

- Form 5500 Preparation, Signing, & Filing

- Form 8955 Preparation, Signing, & Filing

- Fund Change Notice Distribution

- Hardship Withdrawal Approval

- Loan Approval & Reporting

- Loan Default Monitoring

- Loan Policy Administration

- Lost Earnings Calculations

- Participant Enrollment Assistance

- Payroll Aggregation

- Plan Design Review

- Plan Document Interpretation

- Plan Document Preparation & Archiving

- QDIA Notice Distribution

- QDRO Determinations & Reporting

- Required Minimum Distributions

- Safe Harbor Notice Distributions

- Summary Annual Report Production & Distribution

- Summary of Material Modification Notice Distribution

- Summary Plan Description Production & Distribution

- Termination Date Verification & Maintenance

- Termination Withdrawal Approval

- Vesting Verification & Tracking

- Year-End Data Collection & Review

Advantages of Transamerica Choice Pooled Solutions℠

Compliant

Your clients don’t want fines or penalties. The plan uses processes developed to administer plans according to DOL and IRS guidance to avoid compliance issues.

Fiduciary protection

Your clients don’t want to be at risk. By shifting administrative and certain named fiduciary duties to TAG Resources (and the pooled plan provider, if participating in the Choice PEP), employers can significantly reduce their defined legal obligations and responsibilities.

Making it simple

Your clients don’t want to be 401(k) experts. As the plan's third party administrator, TAG Resources supports plan setup, implementation, monitoring, enrollment, and other duties.

Well-known providers

Your clients want to work with industry leaders. Transamerica Choice Pooled Solutions℠ combines industry-leading professional service providers for “end-to-end” retirement plan oversight, including robust tools and resources for employees.

Cost-effective

Your clients don’t want to overpay. Transamerica Choice Pooled Solutions℠ is built on a pooled pricing model and may cost less than other programs offering fewer comprehensive services.

Meet the team

Third party administrator (TPA)

TAG Resources

Recordkeeper

Transamerica

Financial advisor

Bison Wealth

Pooled plan provider

Transamerica Fiduciary Services

Investment manager 3(38)

Auditor

Over 20 years of experience

Business owners trust Transamerica to help provide the right retirement plan choices for their clients

Retirement plan providers are currently struggling to deal with pooled structures. Many are enthusiastically working with pooled plans, such as pooled employer plans (PEPs), for the first time. Transamerica has been an innovator in pooled structures for nearly 25 years. Our experience has helped employers understand how to structure the plan to get the best savings and protection available to you.

We have a proven track record of understanding employers' needs and effectively meeting those needs.

Additionally, retirement plans carry significant fiduciary liability and government compliance exposure for employers. Transamerica Choice Pooled Solutions℠ outsources most fiduciary responsibilities and compliance to TAG Resources to the greatest extent available. While most retirement plans do not offer this level of fiduciary and compliance assistance, TAG works as your retirement department by becoming a signatory named fiduciary on your client’s retirement plan.

Transamerica

24

408

13,513

Participant experience

Driving participant success

The Transamerica participant experience is designed to help people understand if their savings and investment strategy is in line with their retirement goals. It starts with enrollment and continues with personalized communications and financial education showing participants how they can improve their retirement readiness.

An easy-to-understand forecast is generated by the underlying methodology provided by Morningstar. Using simple weather icons, it shows participants if their current investment strategy is likely to produce the income they’re seeking in retirement and offers steps to improve their chances of achieving their goals. Your Retirement Outlook® is featured prominently on the participant website, mobile app, and quarterly statements.